By Damien Ferte

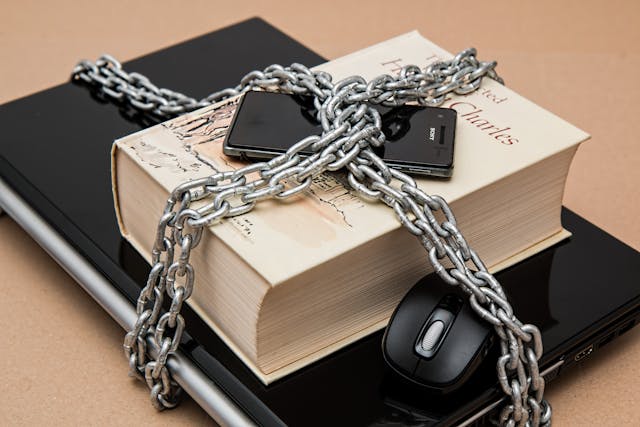

In the rapidly evolving business landscape of China, small and medium-sized enterprises (SMEs) face a myriad of challenges, among which the protection of intellectual property (IP) stands out. With China’s position as a global leader in IP applications and an increasing legal awareness among businesses, understanding how to mitigate IP risks through insurance is more crucial than ever. This article delves into the nuances of IP insurance in China, offering SMEs a roadmap to safeguarding their most valuable assets.

Different Forms of Intellectual Property

Intellectual property encompasses a range of legally protected rights that are crucial for fostering innovation and competition. Here’s a breakdown of the primary types of IP and their significance in the Chinese market:

• Trademarks: Your brand’s identity—be it a logo, trading name, or tagline—must be registered to afford full protection. In China, a notable case of trademark infringement highlighted the need for thorough searches within the Chinese Trademark Office’s database to ensure uniqueness and prevent conflicts. Accidental infringement can lead to substantial legal fees, a scenario preventable through professional indemnity insurance, covering such risks under similar conditions as other liabilities.

• Trade Secrets: These encompass business-critical information, from secret formulae to customer lists, that derive economic value from not being publicly known. In China, the enforcement of non-disclosure agreements (NDAs) is essential for protecting trade secrets, underscoring the need for comprehensive internal security measures.

• Copyrights: Automatic protection is afforded to original works, from literature to art. In China, while registration isn’t mandatory, it facilitates enforcement actions. Copyright infringement, particularly unintentional, is typically covered under Professional Indemnity insurance, offering peace of mind to creators and businesses alike.

• Patents: Granting exclusive rights to inventions for up to 20 years, patents are a cornerstone of IP protection. Given the complexities of patent law in China, consultation with a patent attorney is advisable to navigate the registration process and avoid infringement risks, which might not always be covered under standard insurance policies without specific extensions.

Intellectual Property Risks and Insurance Coverage

IP risks in China entail both first- and third-party liabilities. From legal costs associated with defending one’s IP to financial losses due to infringement claims, the spectrum of risks is broad. For instance, first-party risks include the expenses of litigating against infringers, while third-party risks may involve compensatory damages for unintentionally infringing upon another’s IP rights. Typically, Chinese insurance policies focus on third-party liabilities, covering legal defenses and settlements.

Managing IP Risks Through Insurance in China

Given the nascent stage of standalone IP insurance policies in China, SMEs often resort to incorporating IP risk coverage within broader insurance policies:

• Commercial General Liability Insurance: This policy is pivotal for companies creating content, offering protection against libel or slander, including inadvertent infringement of third-party IP rights. An illustrative scenario could involve a company inadvertently using an image in its marketing materials that infringes on another’s copyright, underlining the policy’s value.

• Professional Indemnity Insurance: Essential for service-oriented businesses, this insurance can be tailored to include IP risk extensions, albeit with limitations. Trademarks, trade secrets, and copyrights can generally be covered, while patents might require a more nuanced approach. Annual policy reviews are recommended to ensure coverage aligns with the company’s evolving IP portfolio.

Conclusion

In the dynamic and competitive environment of China, IP insurance emerges as a critical strategy for SMEs to protect their innovations and creative works. By understanding the different types of IP, recognizing the risks involved, and navigating the available insurance options, businesses can establish a robust framework for IP risk management. Engaging with insurance brokers and legal experts specializing in IP law will further empower companies to customize their coverage, ensuring their assets are comprehensively protected against potential infringements.

If you have any questions in this respect, please don’t hesitate to send us an email with your contact details. You can also visit our website to find out about the other insurance services we offer.

Comments are closed.