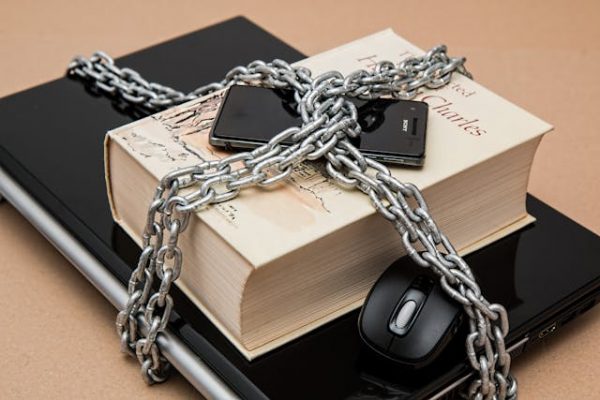

Because your business is your livelihood, securing it against unexpected events should be a priority. It can be done economically through business insurance. For many businesses, insurance isn’t just a means for securing risk. Customers or clients feel safe buying your product or service when they know that you have the financial means to face financial liability that may arise from unexpected issues with your product or service. This, in turn, will help grow your business. Find out why insurance is important for SMEs

What is Business Insurance?

Why get your business insured?

Business insurance is a generic term for all insurances meant to protect a business. It includes coverage for property damage, legal liability or employee-related risks. Depending on the business environment in which your company is operating, you can consider securing your business with property or content insurance, employers’ liability insurance, public liability insurance or professional indemnity insurance. We offer a wide range of policies that cover specific risks in your day-to-day business.

We can advise you on the insurance that will best suit your particular requirements.

How to insure your business?

Our online quotation system has been designed to adapt the insurance coverage to your specific needs. Along the process, our team will assist you if required via telephone, email or online chat.Our online solutions are continuously improving and we are sure you will find a suitable fit for your insurance needs.

Our Business Insurance Solutions

Tell us about your business

Use our online tool to answer a few short questions and we’ll outline the types of coverage you need.

Get a customized quote

After you’ve answered some questions and selected the coverages you need, you’ll get a real-time estimate.

Finalize your policy

If you like what you see, provide us with a few more details and we’ll finalize your policy!